How to trade Sykes Enterprises SYKE With Risk Controls

Technical Summary

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Neutral | Weak | Strong |

| P1 | 0 | 0 | 43.70 |

| P2 | 41.76 | 41.27 | 46.44 |

| P3 | 42.46 | 42.20 | 49.31 |

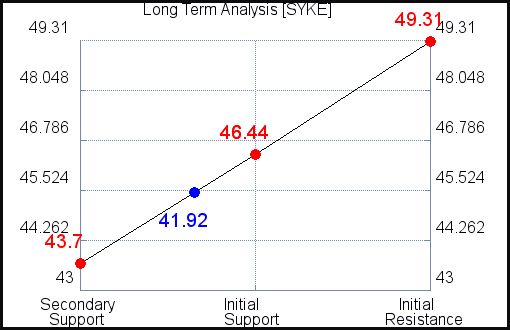

Support and Resistance Plot Chart for SYKE

Longer Term Trading Plans for SYKE

May 29, 2021, 2:45 am ET

SYKE - (Long) Support Plan

NONE.

SYKE - (Short) Resistance Plan

Short under 43.70, target n/a, stop loss @ 43.83

Blue = Current Price

Red = Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Factset: Request User/Pass

Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Our Market Crash Leading Indicator is Evitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change: Take a Trial